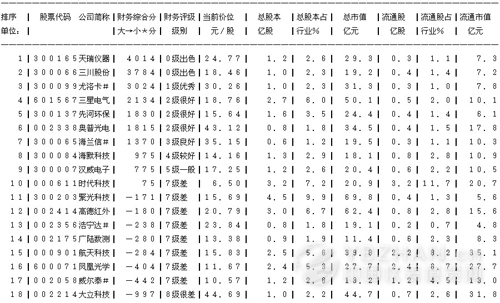

China A-share "Instrumentation & Instrumentation" Industry Finance Business Comprehensive Ability Rating Table 2-1-1

China A-share "Instrumentation & Instrumentation" Industry Finance Business Comprehensive Ability Rating Table 2-1-1 (Sort by good-to-poor according to "financial composite points" of listed companies in the industry)

I. Review of the comprehensive financial management performance of listed companies in the instrumentation industry. There are 23 listed companies in the industry. Among them, there are 6 listed companies with financial comprehensive scores of “2nd level†(above 1800), which are days. Rui Instrument, Sanchuan Co., Ltd., Unioka, Samsung Electronics, and Xianhe Environmental Protection accounted for 26.1% of the total number of companies in the industry, 18.5% of the total share capital of the industry, and 15.5% of the total market value of the industry. These companies accounted for the overall proportion of the industry. Lower, they are stronger than other companies in the industry's financial operations and are the best companies in the industry.

There are 14 companies with listed companies whose financial performance is below “6-level poor†(less than 600 points), accounting for 60.9% of the total number of companies in the industry, accounting for 74.7% of the total share capital of the industry, and accounting for 75.7% of the total market value of the industry. This group of companies accounted for a very high proportion of the industry as a whole, because they make the overall industry financial operating capacity is poor.

In addition, there are three listed companies whose financial scores are “3 to 5 normal†(600 to 1800 points), accounting for 13.0% of the total number of companies in the industry, accounting for 6.7% of the total share capital of the industry, and accounting for 8.8 of the total circulating market value of the industry. %, the overall proportion of these companies in the entire industry is extremely low.

Second, the instrumentation industry is represented by the scale of capital stocks listed company review summary of the industry's existing two major listed companies, companies are self-test shares, Concentration Technology, which accounts for 8.7% of the total number of industries. Accounted for 18.9% of the total capital of the industry, the arithmetic average of each group of financial operations was divided into -1329 points/household for each financial operation, which was a very poor level of 8; the overall weighted average financial operation was divided into -2661 points/share for each financial operation. The grade is poor.

Note 1: Comprehensive financial management capabilities (financial composite points) - this consists of four aspects of the financial performance of listed companies (survival points; redistribution points; auxiliary points, performance points) and dozens of financial indicators. The range is about 5000 (best) to -5000 (worst). There are 10 levels, 0 is excellent, 1 is excellent, 2 is very good, 3 is good, 4 is better, 5 is normal, 6 is poor, 7 is poor, 8 is poor, 9 is very poor.

Note 2: Weighted average per share - weighted average per share = ∑ (all listed companies on the stock market (each piece of data per share X each company's total share capital) plus) / stock market total share capital). That is, the total share capital of the stock company is divided by the set of data after multiplying the company’s total share capital. Reflecting the specific average situation of all the total stocks in the stock market helps to analyze the overall average intrinsic status of the stock market as a unit of equity. The weighted list of listed companies will have an impact on the weighted data of the stock market.

Note 3: Arithmetic per household average - weighted average per share = ∑ (per share of a certain number of listed companies in each stock market / number of listed companies in the stock market). That is, the number of companies in a certain data collection is in addition to the number of companies. It reflects the overall average situation of all listed companies in the stock market and helps to analyze the average surface status of the stock market as a company, regardless of the size or weight of the company.

Note 4: * - Sort items from big to small (small to large).

Semi Enclosed Electric Tricycle

Enclosed Scooter Trike,Cheap Electric Tricycle,Electric Rickshaw For Sale,Semi Enclosed Electric Tricycle

Henan Bosn Power Technology Co; Ltd , https://www.bosnvehicle.com